Target Fund Size

A recognized orthopedic surgeon with over 20 years of experience, Dr. Parekh has created numerous implants and holds over 10 patents. His extensive work in the musculoskeletal field has positioned him as an industry leader in healthcare innovation.

We are proud of the companies we’ve backed and the successes they’ve achieved. From IPOs to acquisitions, our portfolio has demonstrated exceptional growth. We’ve worked with industry leaders and entrepreneurs to bring innovative solutions to the healthcare, with equity multiples ranging from 2.49x to 28x.

Quick & Easy. 15 Minutes.

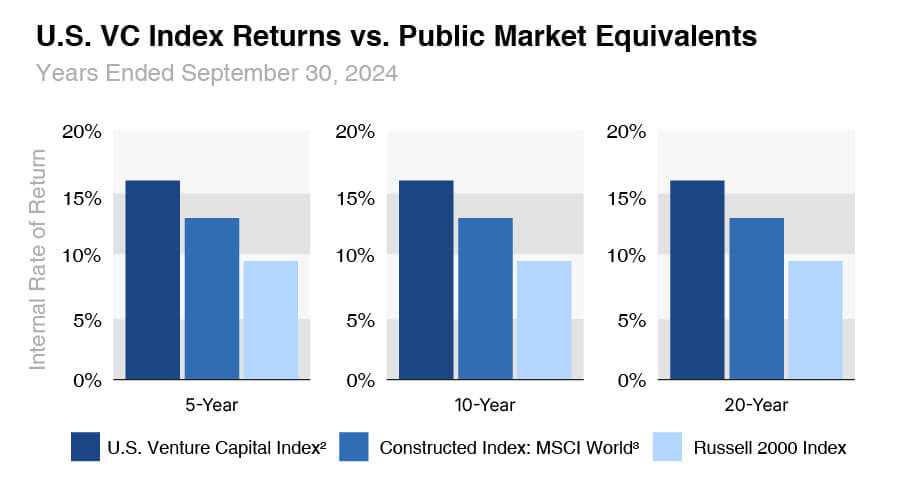

Venture capital has consistently delivered strong returns, outperforming many traditional asset classes over the past 5, 10, and 15 years.

Healthcare innovation, particularly in musculoskeletal care, has been one of the top-performing sectors, providing significant upside potential for investors.

Investments in healthcare innovation are largely uncorrelated with traditional markets, helping reduce overall portfolio risk and increase stability.

More groundbreaking healthcare solutions are being developed in the private markets, and institutional investors are significantly increasing their allocations to this rapidly growing sector.

Unlike traditional venture capital funds our investors Choose the opportunities that best align with their investment goals.

Full visibility into opportunities performance and strategic progress.

Capital can be reinvested or withdrawn as opportunities exit, offering a dynamic investment experience.

Our portfolio has achieved impressive equity multiples, providing strong returns to our investors.

At Scalpel Ventures, we back transformative companies that are creating groundbreaking solutions in the healthcare space. Our portfolio focuses on musculoskeletal care, cartilage regeneration, sports medicine, and other areas where innovation can make a real difference.