Unlock Exclusive Investment Opportunities in Healthcare Innovation

Unlock Exclusive Investment Opportunities in Healthcare Innovation

Scalpel Ventures offers a unique approach where investors select the opportunity they wish to be part of. We carefully curate a range of high-potential opportunities in musculoskeletal care, regenerative medicine. By allowing our investors to choose their individual investments, we provide maximum flexibility and control over their portfolios.

Unlike traditional venture capital funds our investors Choose the opportunities that best align with their investment goals.

Full visibility into opportunities performance and strategic progress.

Capital can be reinvested or withdrawn as opportunities exit, offering a dynamic investment experience.

Our portfolio has achieved impressive equity multiples, providing strong returns to our investors.

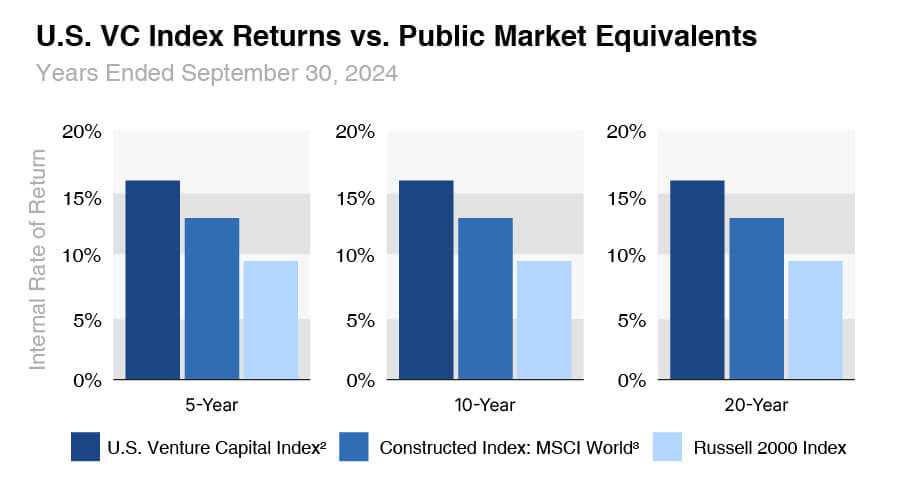

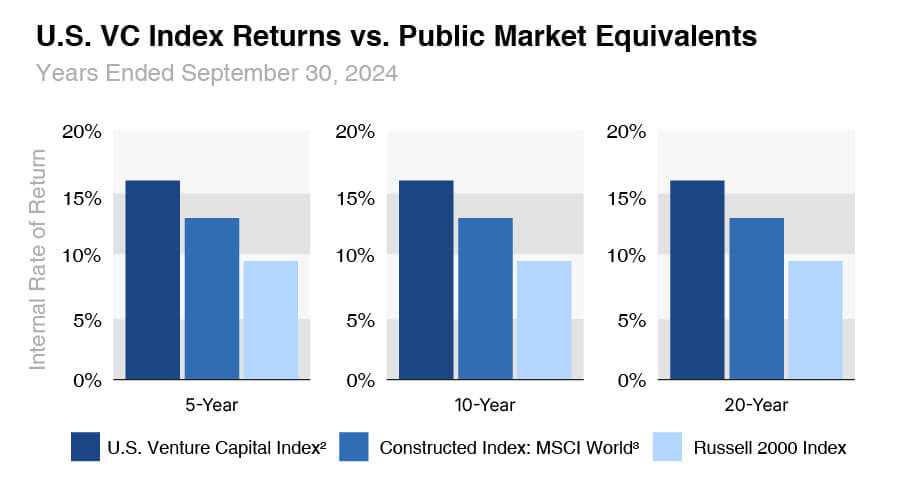

Scalpel Ventures has consistently delivered strong returns, outperforming many traditional asset classes over the past 5, 10, and 15 years.

Healthcare innovation, particularly in musculoskeletal care, has been one of the top-performing sectors, providing significant upside potential for investors.

Investments in healthcare innovation are largely uncorrelated with traditional markets, helping reduce overall portfolio risk and increase stability.

More groundbreaking healthcare solutions are being developed in the private markets, and institutional investors are significantly increasing their allocations to this rapidly growing sector.

Venture capital has consistently delivered strong returns, outperforming many traditional asset classes over the past 5, 10, and 15 years.

Healthcare innovation, particularly in musculoskeletal care, has been one of the top-performing sectors, providing significant upside potential for investors.

Investments in healthcare innovation are largely uncorrelated with traditional markets, helping reduce overall portfolio risk and increase stability.

More groundbreaking healthcare solutions are being developed in the private markets, and institutional investors are significantly increasing their allocations to this rapidly growing sector.

Returns shown are for the U.S. venture capital asset class, not Scalpel Ventures. Venture capital investing involves substantial risk, including risk of loss of all capital invested. Past performance does not guarantee future results. SOURCE: Cambridge Associates Index and Select Benchmark Statistics, Sept 30, 2024

Pick the opportunities that match your goals.

Stay informed about each investment's progress and results.

Reinvest or withdraw capital as opportunities exit, providing flexibility in your investment strategy.

Lorem ipsum dolor sit amet consectetur adipiscing elit, vestibulum dignissim velit interdum posuere vulputate egestas placerat, mattis etiam sem risus nam sapien.

Pick the opportunities that match your goals.

Stay informed about each investment's progress and results.

Reinvest or withdraw capital as opportunities exit, providing flexibility in your investment strategy.

Pick the opportunities that match your goals.

Stay informed about each investment's progress and results.

Reinvest or withdraw capital as opportunities exit, providing flexibility in your investment strategy.